🧭 Quick Navigation

🎯 What is Gamma Pinning?

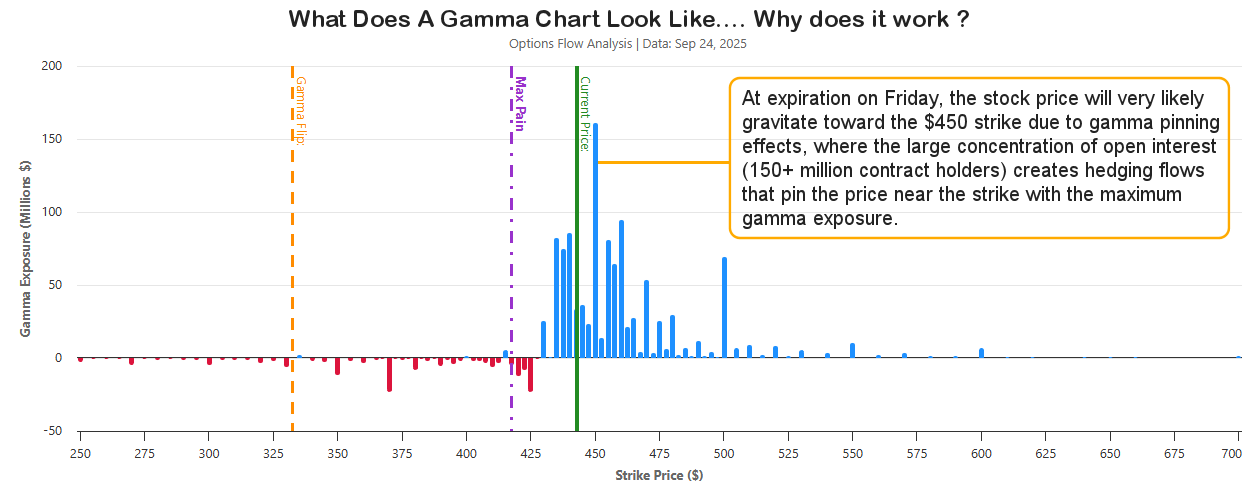

Gamma pinning is a market phenomenon where stock prices tend to gravitate toward and "stick" to major option strike prices as options get closer to their expiration date, especially in the last days hours of trading.

💡 Key Concept

This occurs because market makers who sell options must hedge their positions by buying or selling the underlying stock. As options get closer to expiring, these hedging activities create artificial support or resistance levels at major strike prices.

The Science Behind the Pin

Gamma represents how quickly an option's price changes when the stock price moves. As options get closer to expiring, this sensitivity becomes much stronger for at-the-money options, creating maximum price movement sensitivity.

⏰ Time Sensitivity Timeline

Low Sensitivity

Medium Sensitivity

High Sensitivity

Maximum Pin Effect

Higher gamma = More frequent hedging required

⚙️ How Gamma Pinning Works

Market Makers Sell Options

Market makers provide liquidity by selling both calls and puts. They collect premium but take on risk that must be managed through delta hedging.

Delta Hedging Begins

To remain delta-neutral, market makers buy or sell shares of the underlying stock. For short call positions, they buy more shares as the stock price rises and sell shares as it falls.

Gamma Effect Intensifies

As options get closer to expiring, gamma becomes much stronger for at-the-money options. This means the hedging needs to be adjusted more frequently, requiring more frequent rebalancing.

Price Magnetism Occurs

The constant buying and selling by market makers creates artificial support (for puts) or resistance (for calls) around major strike prices, causing the stock to "pin" to these levels.

📺 Latest Trade Ideas

Watch our latest videos on options trading strategies, market analysis, and gamma pinning techniques

Loading latest videos from our YouTube channel...

📺 Video Topics Include:

- Gamma Pinning Strategies

- Iron Butterfly Setups

- Iron Condor Techniques

- Bull Put Spread Analysis

- Weekly Market Reviews

- Live Trading Examples

- Risk Management Tips

- Market Maker Flow Analysis

🏪 Market Maker Mechanics

📈 Call Option Scenario

If stock rises above strike:

- Market makers must buy more shares

- This creates upward pressure

- But also limits further gains

📉 Put Option Scenario

If stock falls below strike:

- Market makers must sell shares

- This creates downward pressure

- But provides support at strike level

Conditions That Enhance Pinning

- High Open Interest: More contracts = more hedging activity

- Low Volatility: Smaller price movements amplify gamma effects

- Multiple Strike Concentrations: Several strikes with high OI

- Weekly Options: Options that expire weekly create stronger pinning effects

🕐 Think of It Like This...

📅 Like a Deadline Approaching

Just like how you become more focused and active as a work deadline approaches, options become more sensitive to price changes as their expiration date gets closer.

🎯 Like a Magnet Getting Stronger

Imagine a magnet that gets stronger as time runs out - that's how gamma pinning works. The closer to expiration, the stronger the "magnetic pull" toward strike prices.

📋 Trading Strategies

🦋 Iron Butterfly Strategy

Profit from gamma pinning by selling both calls and puts at the expected pin level, while buying protective options above and below.

Structure:

- Sell ATM Call

- Sell ATM Put

- Buy OTM Call (upper wing)

- Buy OTM Put (lower wing)

🦅 Iron Condor Strategy

Similar to butterfly but with a wider profit range, betting that the stock will stay within a specific range due to pinning effects.

Structure:

- Sell OTM Call

- Sell OTM Put

- Buy further OTM Call

- Buy further OTM Put

📈 Bull Put Spread

Take advantage of put support levels by selling puts at expected pin strikes and buying protective puts at lower levels.

✅ Advantages

- Predictable price behavior near expiration

- High probability strategies when properly identified

- Time decay works in your favor

- Can generate consistent income

❌ Risks

- Pin effect may not occur as expected

- News events can override technical levels

- Limited profit potential

- Requires precise timing and strike selection

⚠️ Risks & Considerations

🚨 Important Disclaimer

Gamma pinning is not guaranteed to occur. It's a tendency based on market mechanics, not a foolproof trading strategy. Always manage risk appropriately.

When Pinning May Fail

- Breaking News: Earnings, FDA approvals, or major announcements can override pin effects

- Low Volume: Insufficient trading activity may not create enough hedging pressure

- Competing Forces: Multiple large strike prices may create conflicting pressures

- Market Volatility: High volatility periods can overwhelm gamma effects

💼 Risk Management Guidelines

- Never risk more than 2-5% of your account on a single trade

- Set stop-loss levels before entering positions

- Monitor open interest and volume data

- Have exit strategies for both winning and losing scenarios

- Practice with paper trading before risking real capital

📊 Real-World Examples

📈 SPY Weekly Options

SPY frequently exhibits gamma pinning on Friday afternoons, especially around round-number strikes like $400, $410, etc., due to massive open interest.

🏢 AAPL Earnings Week

Tech stocks often show pinning effects during earnings weeks when implied volatility is high and options activity is concentrated.

⏰ Real-Time Examples

📅 Monday Morning

30+ days to expiration:

Options are like a relaxed person - they don't react much to small price changes.

The stock can move around freely without much "pinning" effect.

🔥 Friday Afternoon

Same day expiration:

Options are like a person with a tight deadline - they react strongly to every price change.

The stock gets "pinned" to strike prices like a magnet.

📚 Further Learning Resources

- Study open interest data on major option chains

- Monitor gamma exposure charts from financial data providers

- Follow market maker flow and positioning reports

- Practice identifying potential pin levels using our trading dashboard

Ready to Apply Gamma Pin Analysis?

Use our advanced analysis tools to identify potential gamma pin opportunities in real-time

Access Trading Dashboard